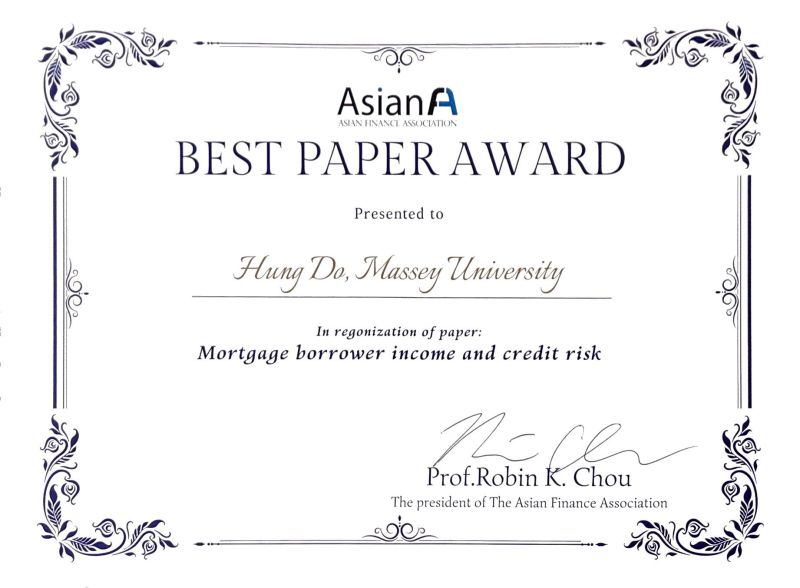

Congratulations to Assoc. Prof. Hung Do for receiving the Best Paper Award at the 2023 Asian Finance Association conference. In this award-wining paper, Hung Do and his co-author Harald (Harry) Scheule, emphasize the need for better financial solutions for low-income households to cope with temporary adverse income shock, and hence contribute to better sustainability in […]

Author Archives: fbnet_eestyn

Financial and Macroeconomic Connectedness is important for a number of financial activities, including but not limited to, risk management, asset allocation, and investment. Since its introduction, the connectedness method proposed by Diebold and Yilmaz (2014) has become one of the most popular econometrics approaches to measuring the connectedness index among financial and macroeconomic variables. There […]

Our member, Dr. Trung Le, provides an R package to perform MIDAS-based VaR and ES forecasting. This package helps to calculate and predict VaR based on the Conditional Autoregressive Value at Risk (CAViaR) model of Engle and Mnagnelli (2004), MIDAS quantile regression of Ghysels et al. (2016). The package can also help to calculate ES […]

Our member, Dr. Trung Le, provides an R package to estimate the Autoregressive Conditional Density Model. There is an introduction to the package written in Vietnamese. You can read more and download the package following the link below. Read More

Our member, Dr. Trung Le, briefly reviews which statistical software can be used in econometrics analyses. The material is written in Vietnamese. Read More

Our member, Dr. Trung Le has written a short document in Vietnamese to illustrate how to perform linear and non-linear regression using R software. You can read more here: Part 1: Linear Regression using R Part 2: Non-linear Regression using R